Growth Design & A/B Testing for Rocket Mortgage

TIMEFRAME TO BUY EXPECTATION SETTING

OBJECTIVE

Improve engagement by setting clearer expectations during the “timeframe to buy” step.

EXPERIENCE

Updated the headline to “Where are you in your home buying journey?” and added a sub-headline. “This will help us tailor your journey.”

RESULTS

+10% uplift in Application Starts

+5% uplift in Soft Credit Pulls

PROJECTED MONTHLY IMPACT

+57 incremental closings

+$19M in closed loan volume

WHY THIS WORKED

This small content change helped set clearer expectations and made the step feel more purposeful. As a result, we saw a 10% increase in application starts and a 5% lift in soft credit pulls, suggesting that users were more confident and engaged moving forward in the flow.

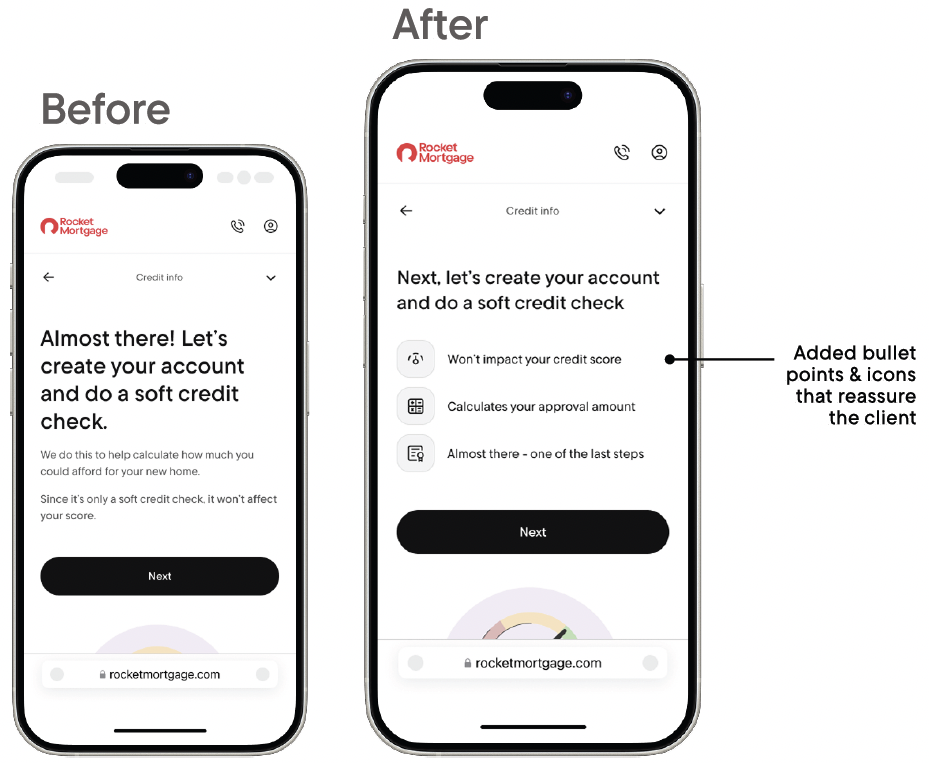

PRE-SSN INTERSTITIAL FOR PURCHASE CLIENTS

OBJECTIVE

Increase conversation through clearer value communication prior to SSN entry.

EXPERIENCE

Introduced a new headline and a bulleted value proposition list clarifying the benefits of the next step.

RESULTS

+7% uplift in Allocations

+5% uplift in Rate Locks

PROJECTED MONTHLY IMPACT

236 incremental closings

$80M in closed loan volume

WHY THIS WORKED

By adding icons and a bulleted list to the Pro-SSN interstitial screen, we made the value of moving forward more immediate and visually scannable. The new headline and clear benefit breakdown helped reduce uncertainty and build before SSN entry.

WELCOME SCREEN CTA

OBJECTIVE

Optimize early funnel engagement by testing CTA copy variants on the Refinance Welcome Screen.

EXPERIENCE

Changed welcome screen CTA from “Start my application” to “See what I qualify for”

RESULTS

+26% uplift in Application Starts

+11% uplift in Soft Credit Pulls

+12% uplift in Apps (70% SS)

+19% uplift in Folders (85% SS)

PROJECTED MONTHLY IMPACT

154 incremental closings

$52M in closed loan volume

WHY THIS WORKED

Changing the CTA to “See what I qualify for” made the action feel more personal, low-risk, and value-driven. This clearer framing likely reduced friction and increased motivation to engage — resulting in a +26% uplift in Application Starts, +11% in Soft Credit Pulls, +12% in Apps, and +19% in Folders.

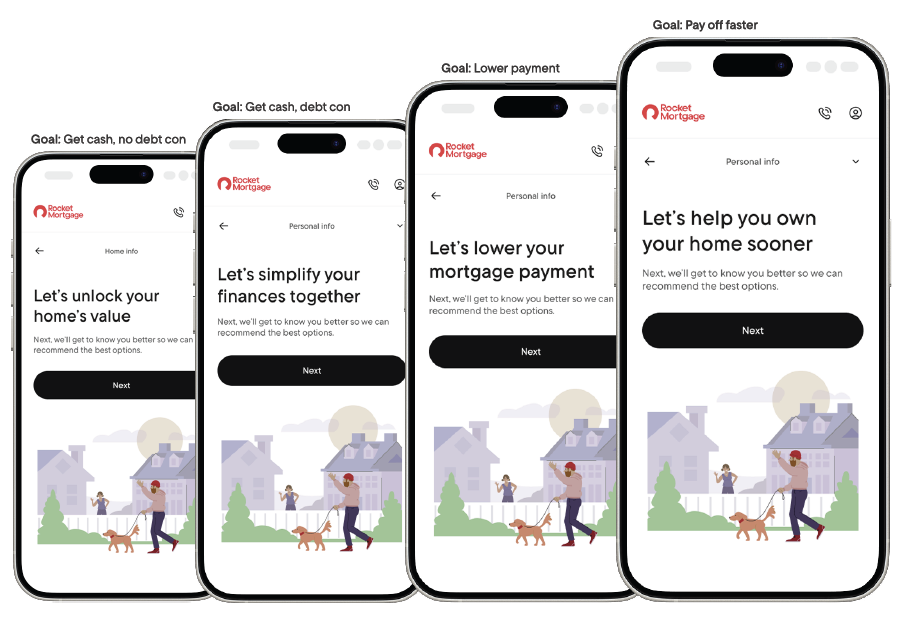

INTERSTITIAL BETWEEN GOAL AND PII

OBJECTIVE

Improve early funnel conversion by reaffirming Unser goals before entering personally identifiable information (PII).

EXPERIENCE

Added an interstitial between refi goal and PII to reinforce user intent and smooth the transition.

RESULTS

+17% uplift in Soft Credit Pulls

PROJECTED MONTHLY IMPACT

236 incremental closings

$80M in closed loan volume

WHY THIS WORKED

Adding an interstitial screen that reinforces the client’s goal and explains why we ask for contact information helps build trust and reduce user hesitation. By clearly framing the value of sharing their info, users feel more informed and in control — leading to a +17% uplift in Soft Credit Pulls.

SSN TEST

OBJECTIVE

Redesigned the UI of the soft credit screens in Refi and Purchase flows to reduce drop-off rates.

EXPERIENCE

Added a friendly card below the input field to reassure users that sharing their SSN won’t affect their credit score, and to explain why we ask for it and paired with playful UI icons to make the message feel clear and approachable.

RESULTS

+30% uplift in Hard Credit Pulls

PROJECTED MONTHLY IMPACT

347 incremental closings

$80M in closed loan volume

WHY THIS WORKED

Ease user hesitation by adding clear, concise messaging that explained why sensitive information like SSN is needed and reassured users it wouldn’t impact their credit score. Friendly visuals and a more transparent experiance built trust and clarity, resulting in higher completion rates and reduced drop-off.